Last summer, we wrote about the boom in the UK residential property market and its prerequisites. Today we will talk about the results of 2021 and what has changed by the beginning of 2022.

UK and London

After a slight decline in December, in early 2022, the demand for housing in the UK shot up again. The influx of buyers in January was 49% higher than the average for the same period of 2018-2021, and this is the biggest New Year’s jump in five years. Record demand was recorded for all types of residential real estate: both houses and apartments.

All of these buyers are competing for a meager number of properties on the market. In January, their number was 44% less than the average for the past five years. However, starting the end of 2021, the situation is gradually improving. There is a growing correlation between the types of homes that buyers want the most and those that are available.

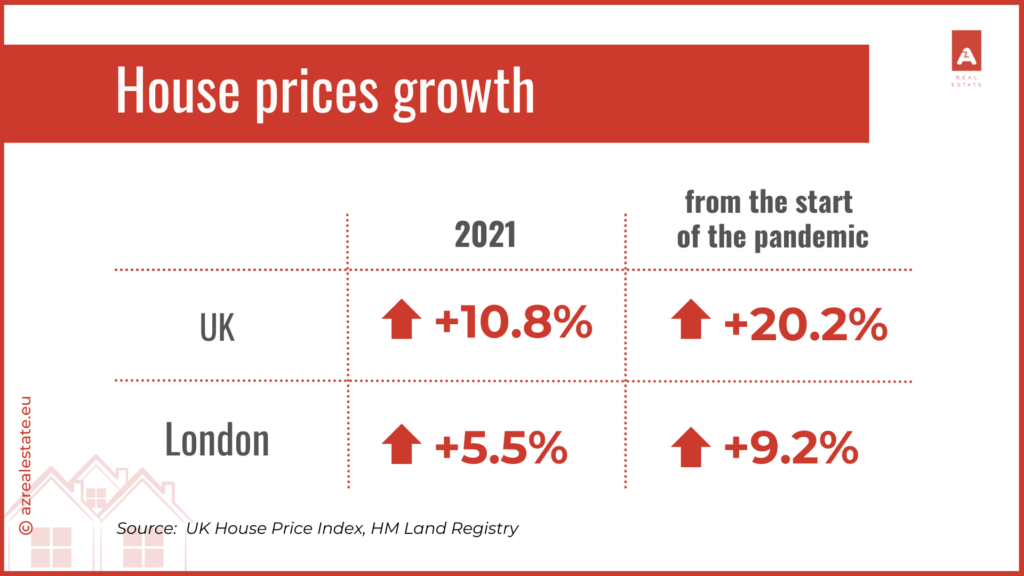

For 2021, average residential property prices in the UK increased by 10.8%, and in London – by 5.5%. In total, since the beginning of the pandemic, homes prices have risen by 20.2% in the UK and by 9.2% in London.

Both buyers and sellers want to close the deal as quickly as possible. It now takes an average of 29 days from putting a house up for sale to receiving an offer (it was 50 days before the pandemic).

Central London

The luxury real estate market in Central London has also revived in 2021. According to Lonres, the prices increased by 7.2% over the year. A record number of deals were concluded: 26% more than the average for the previous five years, and 43% more than in 2020. Due to such high activity, there were almost no properties available for purchase by the end of the year. In December, they were 17% less than a year earlier.

As a result, the number of off-market transactions has increased, which means properties were being sold through inter-agency channels before entering the open market. In 2021, a third of central London agents surveyed by Lonres completed more than half of their deals off-market.

Why is everything growing?

All this is happening against the backdrop of record inflation over the past ten years (4.9% for 2021) and high volatility in stock markets. During the pandemic, the UK Government has given away a total of £315bn to support the economy, and this money supply continues to create additional inflationary pressure. People are looking for ways to invest and save money, and many opt for real estate.

Even the raise of the base rate by the Bank of England to 0.5% does not stop buyers much. Paradoxically, real mortgage rates in February were lower than at the end of 2020, when the base rate was 0.1%. In 2020, banks factored in the risks and uncertainty caused by the coronavirus into their mortgage rates, and now you can get a loan on even more favourable terms.

Rents in Central London*

From hatred to love – this is how you can describe what happened in 2021 with residential lettings in Сentral London. Throughout 2020, the cost of rent there was falling, and by the beginning of 2021, it was 16% lower than before the pandemic. Empty office districts have lost their appeal for those who could now work from home or study online. It was the tenants’ market: they set the terms and bargained because they had 83% more properties to choose from than at the beginning of 2020.

But by the summer of 2021, most of these properties were swept away by the influx of international students and professionals returning to the offices. Living in the center has become fashionable again. And expensive. Since then, the rental market has become the one of landlords’ who were raising prices and choosing tenants from hundreds of applications. Now, good properties are often let before they even hit the open market, sometimes only by video tours, and sometimes even without them.

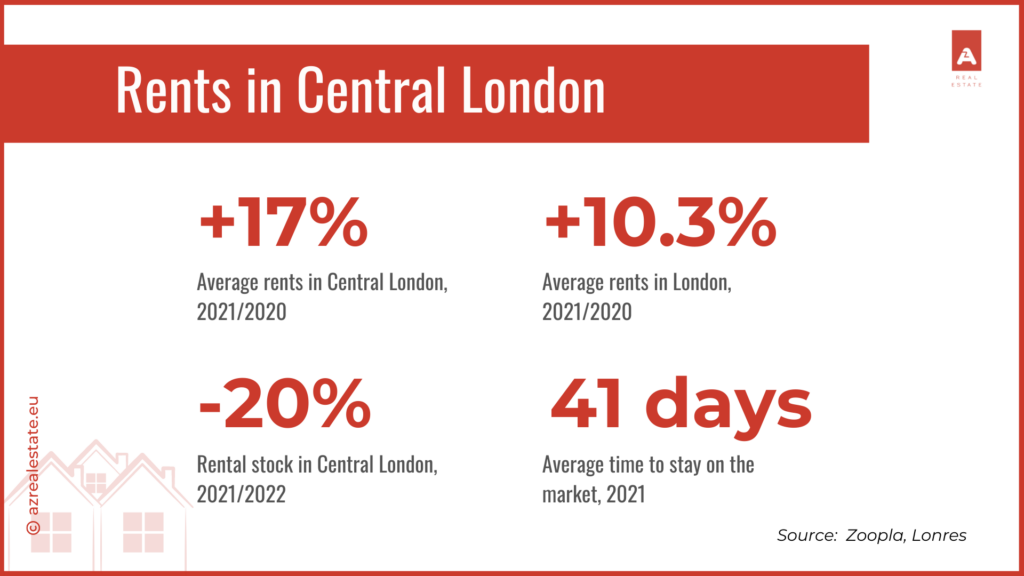

The 2021 results for Central London are as follows:

- Rents jumped by 17% in a year – more than anywhere else in the UK and more than anywhere else in London. For comparison, on average in London, according to Zoopla, rents increased by 10.3% in 2021.

- The number of apartments offered for rent in 2021 was 20% less than in 2020.

- The average time for an apartment to stay on the market was 41 days at the end of 2021 (at the end of 2020 it was 71 days).

In December 2021, the number of properties available for rent in Central London continued to fall. Therefore, this year we expect further growth in rental prices.

*Data source – Lonres analytical agency

What does this mean for buyers and tenants?

To sum up, we expect further growth in residential property prices in London and the UK, although not as intense as in the previous two years. Zoopla estimates that in 2022, housing prices could rise by 3% in the UK and by 2% in London.

When there is a shortage of properties available for purchase and rent, which exists now, a significant part of the transactions are being made “behind closed doors”. Usually, these are the best properties of the highest quality that do not enter the open market. In this situation, we recommend that buyers and tenants do not rely on information from portals, but register directly with all local agents that operate in the area of interest to you. This is not a guarantee of getting the full picture, but it increases your chances to get to know about new properties in time.

A more reliable option is to use the services of AZ Real Estate, and we will do this work for you. We have full access to all sources of information about all properties on the market, including low-key inter-agency databases and private leads through established relationships with other agents. Our consultants will be happy to help you find the right house or apartment for you.

Published 11 March 2022

Other news:

Talking Heads: On Russia sanctions & the London property market

Dark kitchens: how to choose premises for a takeaway food delivery service